Loan Automation System

About Loan Automation System

A Loan Automation System powered by Blockchain, AI, and Cloud technologies can transform the lending process, enhancing security, efficiency, and customer focus.

How each technology can contribute

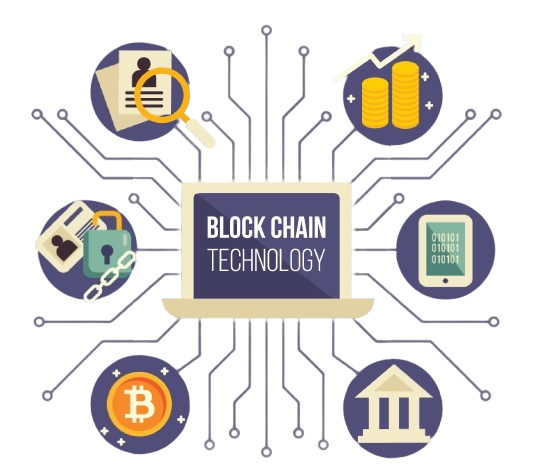

Blockchain

Immutable Records: Blockchain technology guarantees tamper-proof and traceable transaction records, providing a reliable system for tracking loan histories and agreements with utmost accuracy.

Smart Contracts: Automate the loan disbursement and repayment process with predefined conditions. Funds are released automatically once all verifications are successfully completed, ensuring seamless and transparent transactions.

Fraud Prevention: Enhance security and prevent identity theft by securely storing borrower credentials in a decentralized and immutable system, reducing the risk of fraud.

Artificial Intelligence (AI)

Credit Scoring & Risk Assessment: AI leverages advanced data analysis to evaluate applicant risk, enabling quicker and more precise lending decisions.

Process Automation & Document Verification: AI-driven OCR technology automates document verification, streamlining processes and significantly reducing approval times.

Personalized Offers & Recommendations: AI tailors loan offers to individual needs and ensures round-the-clock assistance through intelligent chatbots.

Cloud Computing

Scalability & Accessibility: Cloud platforms offer flexible scalability and ensure seamless accessibility for loan processing across multiple branches.

Secure Data Storage & Analytics: Robust data storage solutions paired with advanced analytics tools provide valuable insights, enabling smarter decision-making.

Improved Collaboration: Facilitates smooth integration with third-party services, streamlining and enhancing the efficiency of the lending process.